FAFSA/ORSAA (CO2024)

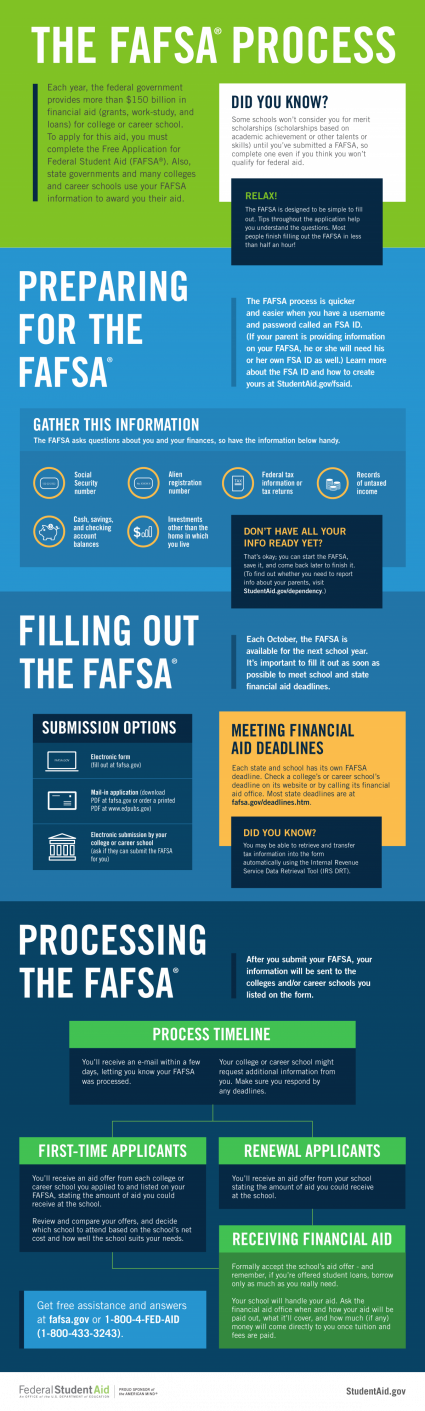

COMPLETING YOUR FAFSA or ORSAA is the first step in applying for money to help pay for college. Even if you don't qualify for a *PELL grant (free money from the government you don't have to pay back*), you should still fill out a FAFSA or ORSAA to see if you qualify for better loans &/or work study.

FAFSA = Free Application for Federal Student Aid: Fill out the FAFSA if you are a U.S. citizen or eligible non-citizen.

ORSAA = Oregon Student Aid Application: Fill out the ORSAA if you are NOT a U.S. citizen or eligible non-citizen, or if you have DACA status.

Use the FAFSA/ORSAA Pre-filter tool to verify which application you should complete.

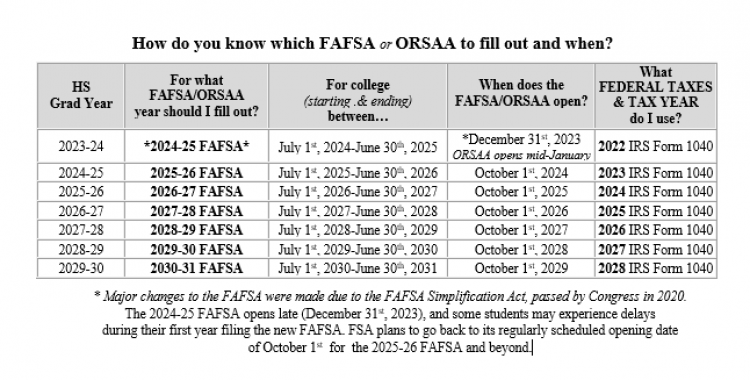

The FAFSA has gone through some major changes this year due to the FAFSA Simplification Act, passed by Congress in 2019. Starting with the 2024-25 FAFSA application cycle (for students in college from July 1st, 2024 through June 30th, 2025), students and parents may notice differences that were designed to make federal student aid accessible to more people. There's a new look, some new terms, and delays for many due to programming issues that have yet to be resolved by FSA.

Federal Student Aid (FSA) is not processing FAFSAs until the first half of March, which means that many colleges and universities won't be able to get their financial aid packages/award letters out to students in time for National Decision Day (usually on May 1st). University-bound students are usually required to officially declare which school they want to attend in the fall and pay any deposits and fees that are due by National Decision Day. However, due to issues and problems a lot of students are facing when trying to file their FAFSAs, many schools have decided to push decision day out to June 1st this year to give students a better chance to review their aid packages before making their final commitments and paying deposits.

If you're not sure if your school has extended their deadline for decision day, contact the admissions office at your school(s).

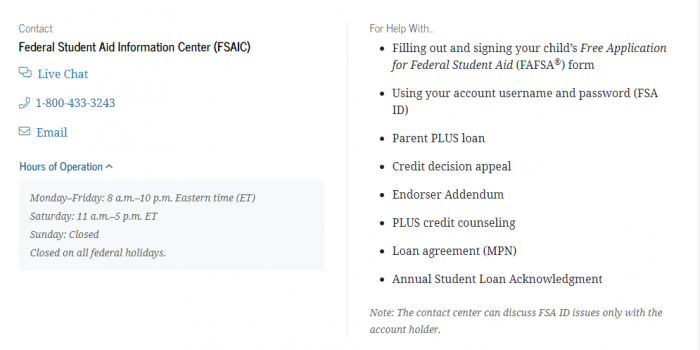

Do you have questions? Do you need help with your FAFSA? Are you stuck on any of the sections? Are you having problems submitting your FAFSA?

Federal Student Aid (FSA) Customer Service1-800-433-3243, email or live chat with a FAFSA representative.

FAFSA representatives will ONLY speak with the student or the parent. They will not give information to anyone else, including a mentor/advocate, or school official.

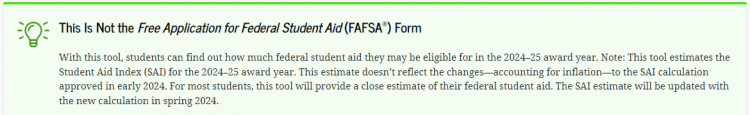

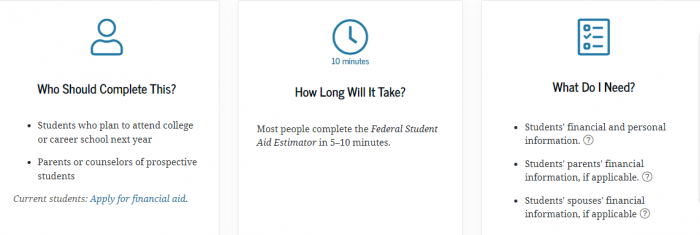

Try the new Federal Student Aid Estimator

You can use the Federal Student Aid Estimator to estimate how much federal aid you may be eligible to receive before you start your FAFSA.

Try the Federal Student Aid Estimator tool today!

IMPORTANT Things to know about the 2024-25 FAFSA...

IMPORTANT CHANGES to know about before you can start the 2024-25 FAFSA...

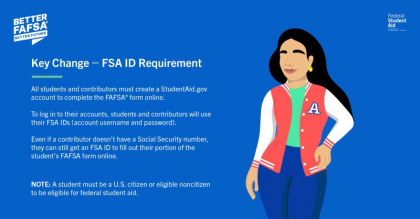

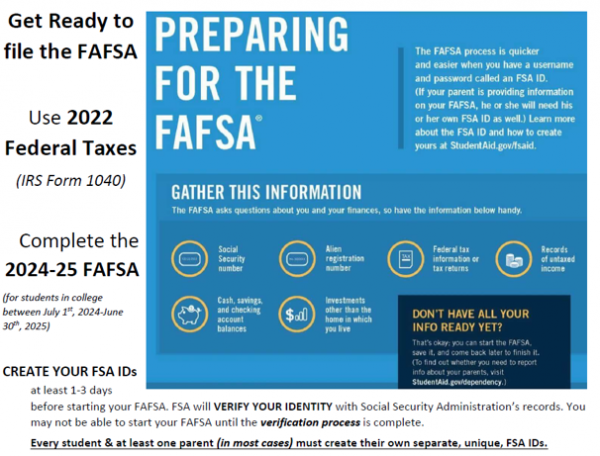

Every student and their parent/contributor must CREATE AN FSA ID (separate & unique usernames/passwords) BEFORE you can start the FAFSA. It's recommended that every student and at least one parent CREATE THEIR FSA IDs at least three days before coming to FAFSA/ORSAA Night.

There may be a delay of 1-3 business days from the time you create your FSA IDs for FAFSA to verify your identity with Social Security Administration. We can help you with your FSA ID at FAFSA Night, but you may not be able to go any further on the application until the verification process is complete.

Tips & Resources on: Applying for financial aid & Filling out the FAFSA

https://studentaid.gov/apply-for-aid/fafsa/filling-out

How to Prepare for the 2024-25 FAFSA/ORSAA

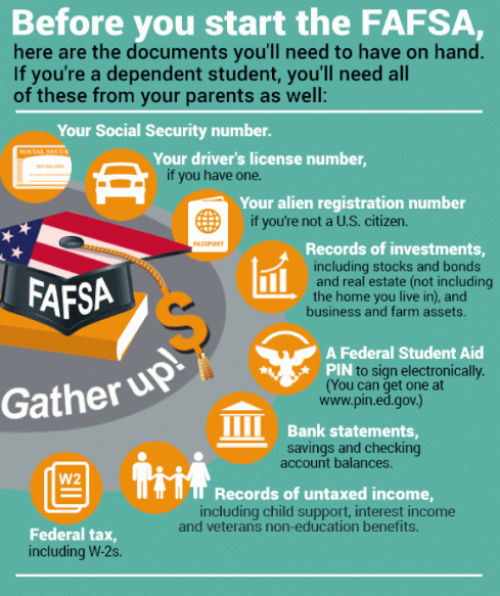

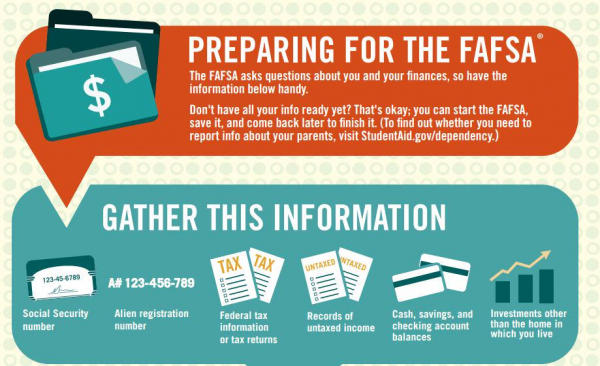

1. GATHER your documents BEFORE you start the FAFSA or ORSAA.

1. GATHER your documents BEFORE you start the FAFSA or ORSAA.

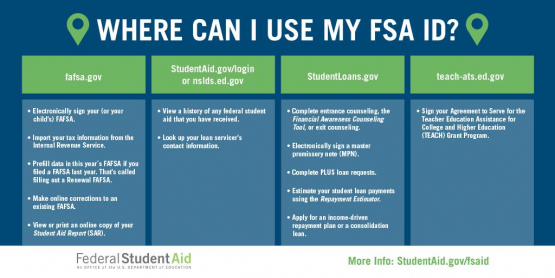

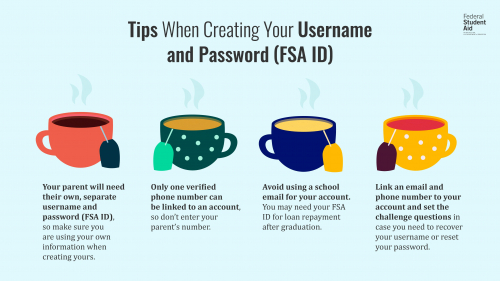

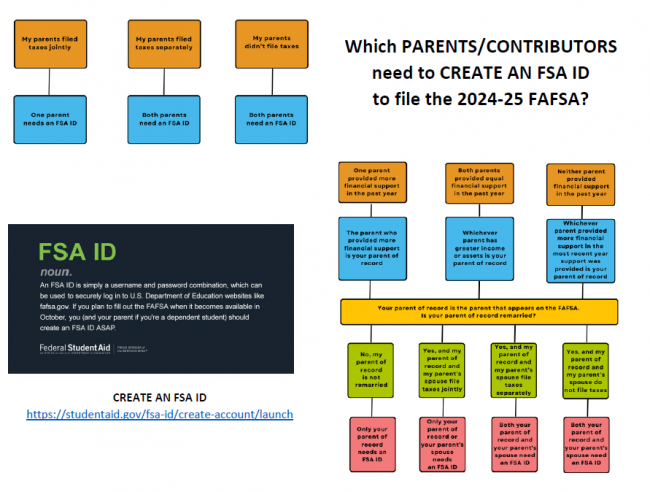

2. CREATE YOUR FSA IDs - Every student AND at least one parent need to CREATE separate & unique FSA IDs to sign & submit FAFSA electronically. You should create your FSA IDs before coming to a FAFSA Night, because there may be a 1-3 day delay while FSA verifies your identity with the Social Security Administration. Students may not be able to start their FAFSA until the verification process is complete.

CREATE YOUR FSA IDs here

IMPORTANT: The new FSA ID requirement is for everyone! You can no longer print signature pages; all FAFSAs must be signed electronically. That means parents must have their OWN email addresses to verify their own accounts. Students and parents are not allowed to create or access each others' accounts.

Steps to CREATE AN FSA ID...

Try to CREATE YOUR FSA ID before coming to a FAFSA Night, as you may not be able to start the FAFSA until the verification process is complete. There may be a delay of 1-3 days while waiting for your account to be verified.

Dependency Status on the FAFSA: Who is my FAFSA Parent(s) / Contributor(s)? Who Needs an FSA ID?

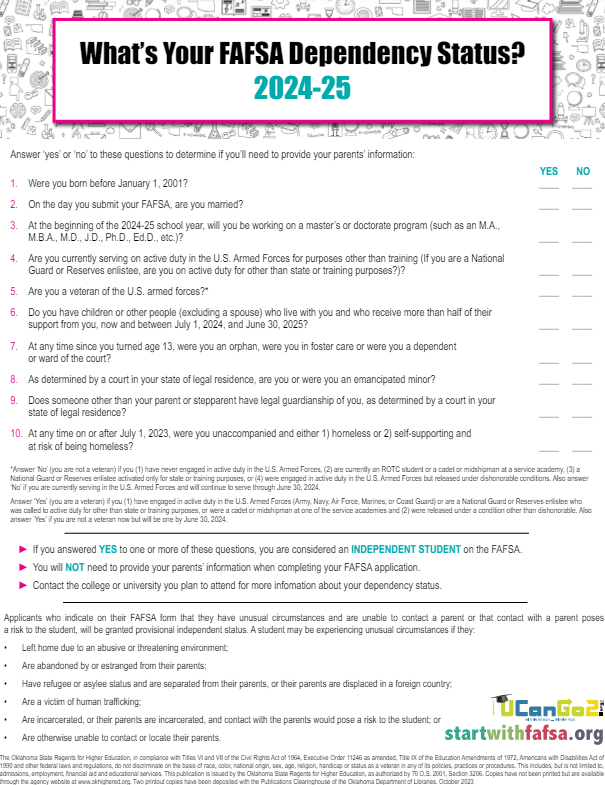

- DEPENDENT students are required to provide parental information and financials on the FAFSA or ORSAA. If a student answers "NO" to all of the Dependency Status questions below, they are considered DEPENDENT students, and must provide parent info until they turn 24 years old, even if the student doesn't live with the parent(s). Most high school students are considered DEPENDENT students for FAFSA/ORSAA purposes.

- INDEPENDENT students DO NOT have to provide parental information on the FAFSA or ORSAA. A student who can answer "YES" to any of the Dependency Status questions below, they are considered an INDEPENDENT student for FAFSA or ORSAA purposes.

What's your FAFSA Dependency Status?

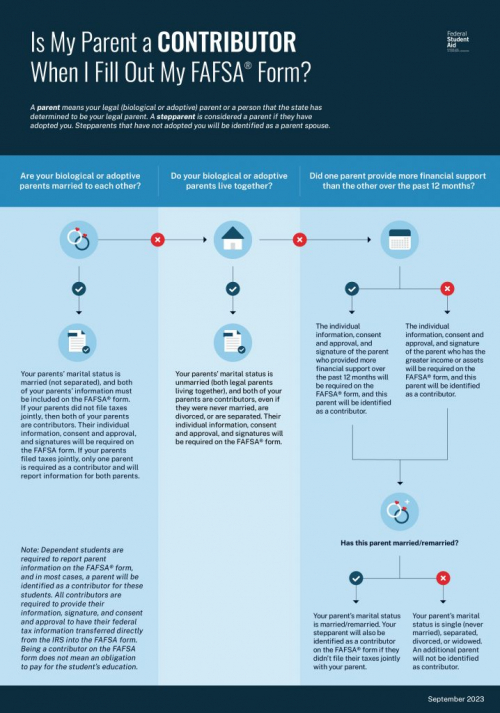

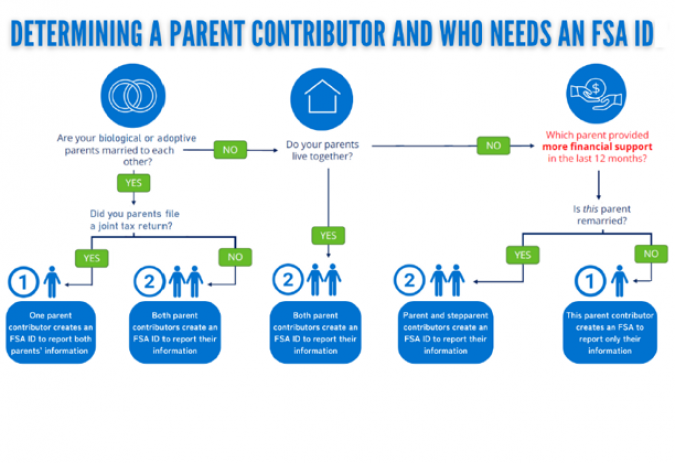

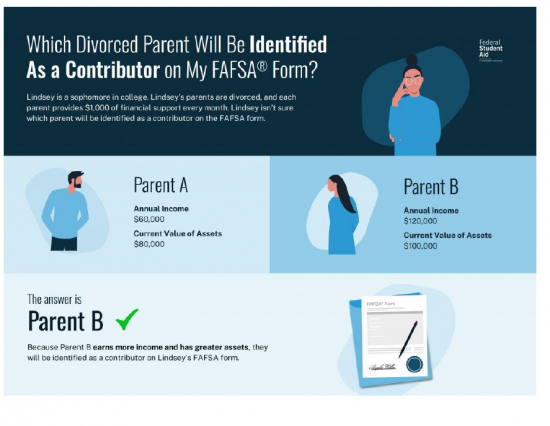

Who's my FAFSA/ORSAA Parent/Contributor?

To find out which parent(s) need to contribute information to their student's FAFSA or ORSAA, use the infographics below to determine who you need to invite in order to complete the parent sections of the 2024-25 FAFSA, including financial/tax information.

Other Resources to help pay for post-high training & college

Oregon Opportunity Grant - Oregon's largest NEEDS-BASED grant (based on student & parent income from prior tax year, as determined by FAFSA or ORSAA. The money runs out, so APPLY for FAFSA/ORSAA ASAP after the applications open to qualify for all the FREE MONEY you can!

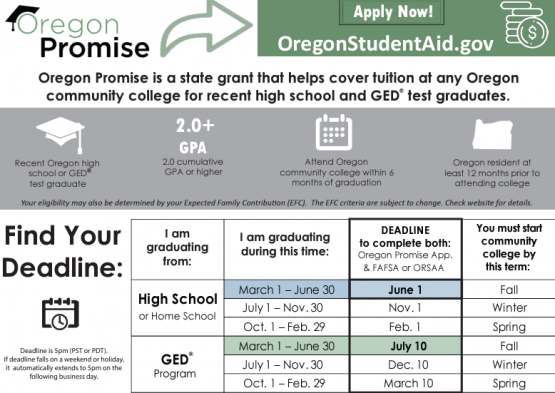

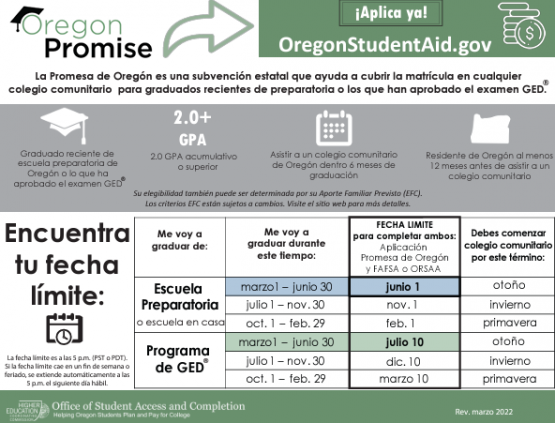

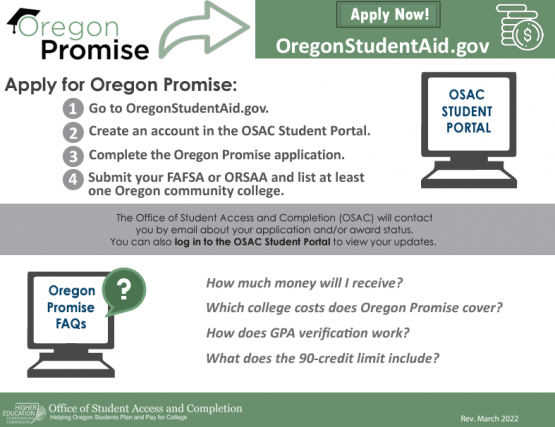

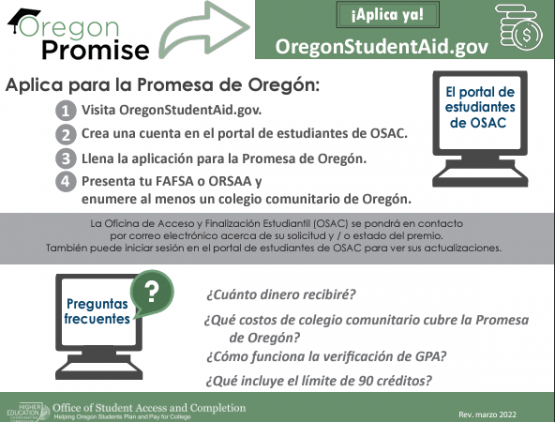

Oregon Promise Grant - Free Tuition & Fees at Oregon Community Colleges (for those who qualify)

Oregon Promise Grant - FREE/LOW-COST tuition at any Oregon community college

You can qualify for the Oregon Promise Grant if you have...

- 2.0+ GPA by the end of senior year

- Lived in Oregon 12+ months before starting college

-

Completed & submitted your FAFSA/ORSAA by June 1st

- Listed at least ONE Oregon community college on your FAFSA or ORSAA

- Completed & submitted the Oregon Promise application by June 1st

- Enroll at least 1/2 time (6+ CR) at an Oregon community college the term directly following graduation (excludes summer!)

OSAC Scholarships

OSAC Scholarship Application - DUE April 1st

(Early Bird Deadline: Submit by February 15th to have your name entered into a drawing for a $1,000 scholarship!)

Fill out ONE application to apply for multiple scholarships!