Financial Aid & Paying for College

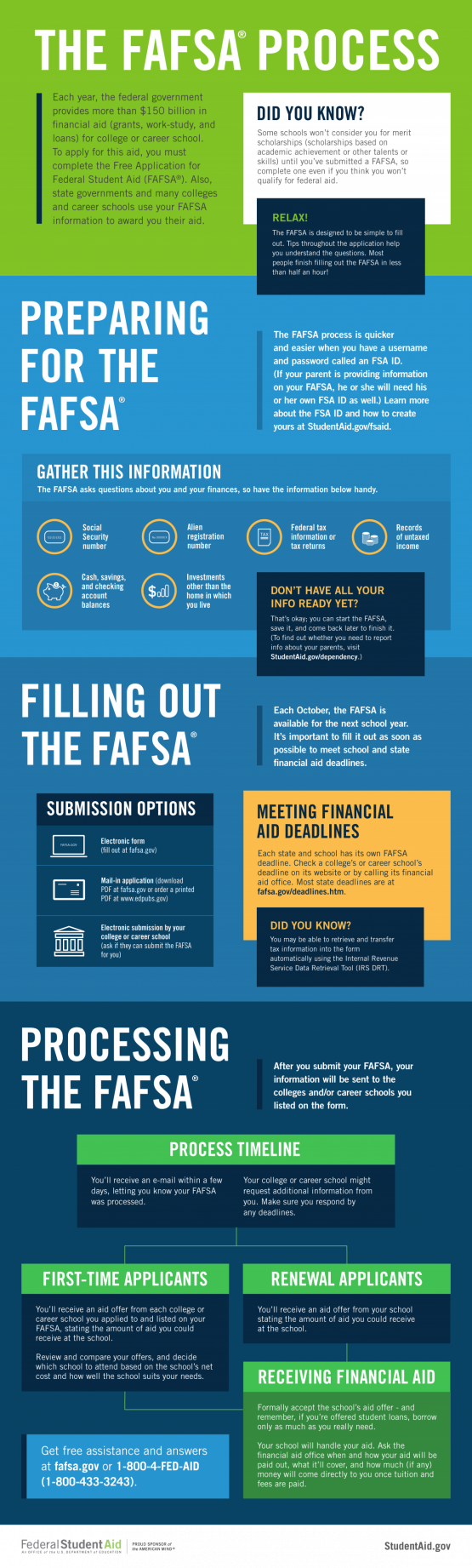

COMPLETING YOUR FAFSA or ORSAA is the first step in applying for money to help pay for college. Even if you don't qualify for a PELL grant (free money from the government you don't have to pay back), you should still submit a FAFSA or ORSAA because you may qualify for subsidized loans with lower interest rates, institutional aid and scholarships, &/or work study.

Did you know...many scholarships offered by 3rd parties may REQUIRE you complete a FAFSA or ORSAA to qualify for scholarships.

Do your FAFSA or ORSAA as soon as possible after it opens on October 1st!

FAFSA = Free Application for Federal Student Aid | ORSAA = Oregon Student Aid Application

-

How do I know whether I should complete the FAFSA or ORSAA?

-

Use the FAFSA/ORSAA Filter Tool to determine which financial aid application you should complete.

-

U.S. citizens & eligible non-citizens should complete the FAFSA.

- Funding for FAFSA comes from the federal government, and information is shared with Federal Student Aid & participating colleges.

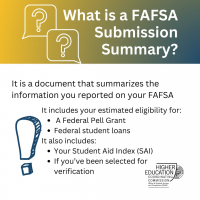

- FAFSA is based on income from the prior tax year. Students who qualify may get grants (like the Pell Grant), federal student loans, institutional aid, scholarships, and work-study programs funded by the federal government.

-

Oregon residents who are undocumented, have DACA-mented status (Deferred Action for Childhood Arrivals), or have TPS (Temporary Protected Status) should fill out the ORSAA.

- Funding for ORSAA comes from the state of Oregon (not the federal government), and is completely confidential. Your information is NOT shared with any other agencies or other branches of government.

- ORSAA is based on income from the prior tax year. Students who qualify may get state grants and scholarships through the state of Oregon, such as the Oregon Opportunity Grant, Oregon Promise Grant, and certain need-based scholarships.

-

U.S. citizens & eligible non-citizens should complete the FAFSA.

-

Use the FAFSA/ORSAA Filter Tool to determine which financial aid application you should complete.

What Do I Need To Complete the FAFSA & ORSAA?

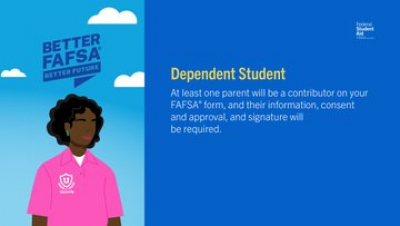

Figure out your DEPENDENCY STATUS. Find out if you're a DEPENDENT or INDEPENDENT student by answering FAFSA's Dependency Status questions.

- If you answer "NO" to every dependency status question, you are a "DEPENDENT" student; FAFSA requires info for both the student and parent(s).

- If you answer "YES" to any dependency status questions, parental info is NOT required.

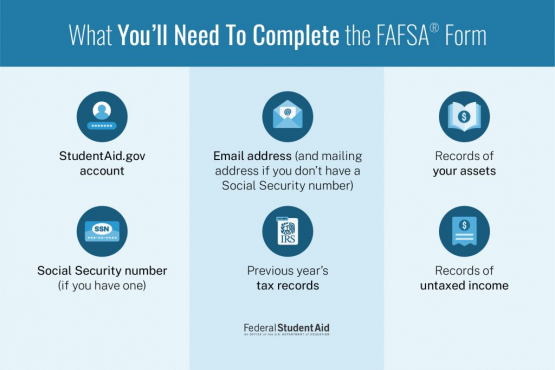

To file the 2026-27 FAFSA, every dependent student and at least one parent (contributor) will need:

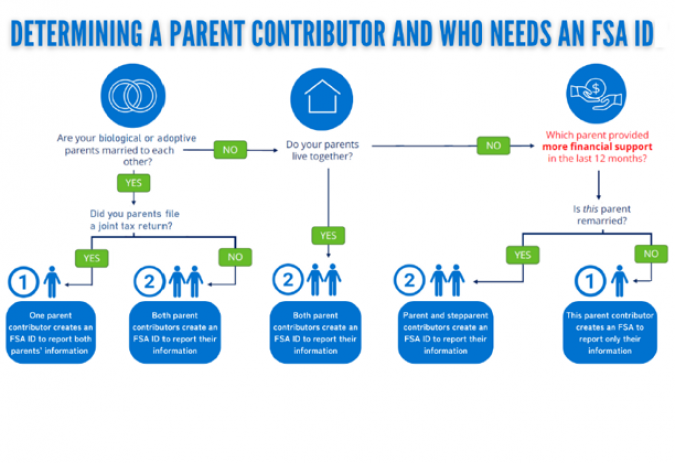

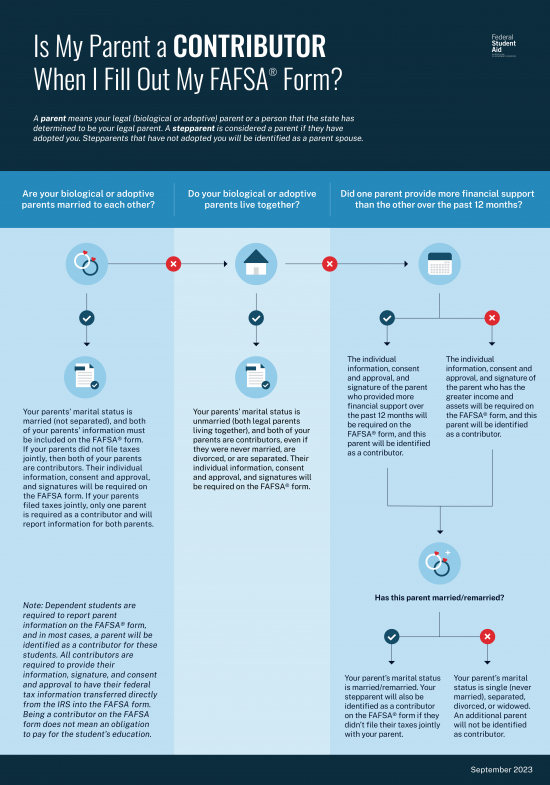

Use FAFSA's Parent Wizard Tool to determine which parent(s) need to contribute info to your FAFSA. The Parent Wizard Tool will also tell you who needs to create an FSA ID.

|

If you graduate in... |

Fill out FAFSA year... | For students in college from... | Use Federal Taxes (IRS Form 1040) from... | ||

| Class of 2026 | 2026-27 | July 1st, 2026 - June 30th, 2027 | 2024 | ||

| Class of 2027 | 2027-28 |

|

2025 | ||

| Class of 2028 | 2028-29 |

|

2026 | ||

| Class of 2029 | 2029-30 |

|

2027 | ||

| Class of 2030 | 2030-31 |

|

2028 | ||

| Class of 2030 | 2031-32 |

|

2029 |

|

Preparing for the 2026-27 FAFSA/ORSAA

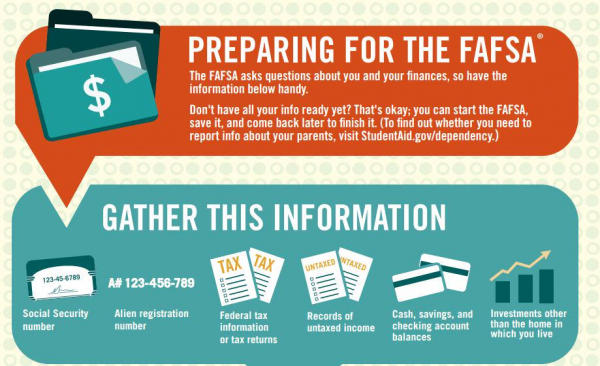

1. GATHER your documents BEFORE starting your FAFSA or ORSAA.

2. Use FAFSA's new Parent Wizard tool to determine which parent(s) need to contribute information to a student's FAFSA, as well as which one(s) need to create an FSA ID. https://studentaid.gov/fafsa-apply/parents

3. CREATE YOUR FSA IDs - Every student AND at least one parent need to CREATE separate & unique FSA IDs to sign & submit FAFSA electronically.

Use FAFSA's Parent Wizard tool before starting your FAFSA. It will tell you which parent(s) are required to contribute info on your FAFSA, as well as which one(s) need to create an FSA ID.

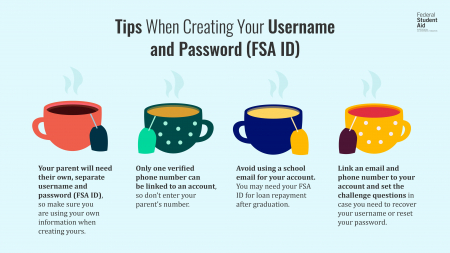

Creating an FSA ID

To create an FSA ID, you must have your OWN email address and phone number, and verify your own accounts. Parents must have a separate email account from their student. Students and parents are not allowed to create or access each others' accounts.

Don't forget to use FAFSA's Parent Wizard tool so you know which parent(s) need to contribute info to your FAFSA and who needs to create an FSA ID.

IMPORTANT: The

ew FSA ID requirement is for everyone...you can no longer print signature pages! All FAFSAs must be signed electronically, and that means parents/contributors must create a separate and unique FSA ID account than their studen

Dependency Status on the FAFSA: Who is my FAFSA Parent/Contributor? Who Needs an FSA ID?

What's your FAFSA Dependency Status?

- "DEPENDENT" students are required to provide parent information (including tax & financial info) on their FAFSA or ORSAA. If a student answers "NO" to all of the Dependency Status questions below, they are considered "DEPENDENT" students, and must provide parent info until they turn 24 years old, even if the student doesn't live with the parent(s). Most high school students are considered "DEPENDENT" students for FAFSA/ORSAA purposes.

- "INDEPENDENT" students DO NOT have to provide parental information on the FAFSA or ORSAA. A student who can answer "YES" to any of the Dependency Status questions below are considered an "INDEPENDENT" student for FAFSA or ORSAA purposes.

Students can determine your DEPENDENCY status here, or by answering the DEPENDENCY QUESTIONS below.

For the 2026-2027 school year, FAFSA asks:

- Were you born before January 1, 2003?

- As of today, are you married? (Answer "No" if you are separated but not divorced.)

- At the beginning of the 2026-2027 school year, will you be working on a master's or doctorate program (such as an M.A., MBA, M.D., J.D., Ph.D., Ed.D., graduate certificate, etc.)?

- Are you currently serving on active duty in the U.S. Armed Forces for purposes other than training? (If you are a National Guard or Reserves enlistee, are you on active duty for other than state or training purposes?)

- Are you a veteran of the U.S. Armed Forces?

- Do you have children or other people (excluding your spouse) who live with you and who receive more than half of their support from you now and between July 1, 2026, and June 30, 2027?

- At any time since you turned age 13, were you an orphan (no living biological or adoptive parent)?

- At any time since you turned age 13, were you a ward of the court?

- At any time since you turned age 13, were you in foster care?

- Are you or were you a legally emancipated minor, as determined by a court in your state of residence?

- Are you or were you in a legal guardianship with someone other than your parent or stepparent, as determined by a court in your state of residence?

- At any time or or after July 1, 2025, were you unaccompanied and either (1.) homeless or (2.) self-supporting and at risk of being homeless?

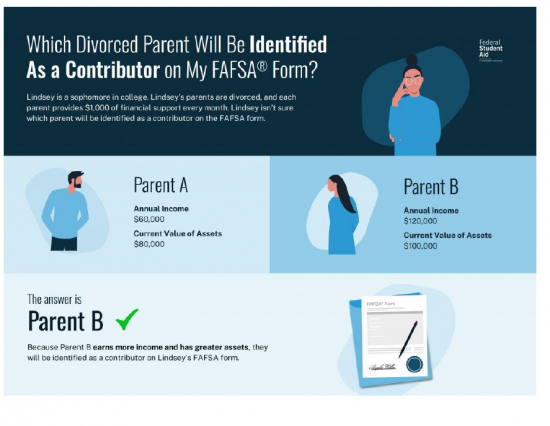

Parent Contributors on the FAFSA & ORSAA

The Parent Wizard Tool will help you determine which parent(s) must provide information on your FAFSA or ORSAA. It will also tell you which parent(s) need to create an FSA ID.

Use the Parent Wizard Tool before starting your FAFSA or ORSAA!

Try the Federal Student Aid Estimator to find out how much aid you might be eligible to receive!

You can use the Federal Student Aid Estimator before you start your FAFSA to find out how much federal aid you may be eligible to receive.

Try the Federal Student Aid Estimator tool today!

FSA Support

Do you have questions or need help with your FAFSA?

Contact Federal Student Aid's (FSA) Customer Service Center: 1-800-433-3243. You can also email or live chat with a FAFSA representative.

FAFSA representatives will ONLY speak with the student or parent about the sections of the FAFSA they are working on. They will not give information to anyone else, including a mentor/advocate, counselor, or other school official.

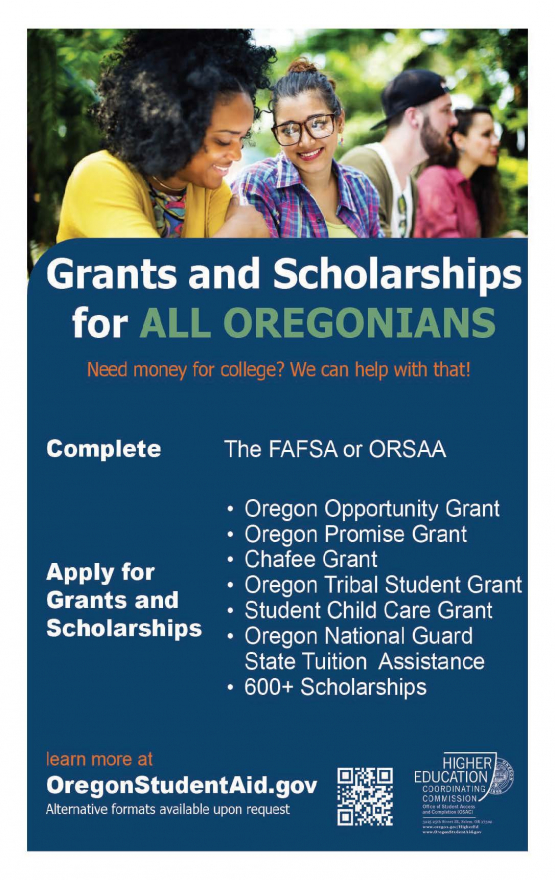

Other OSAC / HECC Resources for Students & Families (financial aid & state grants)

College Funding Grants & Terms You Should Know:

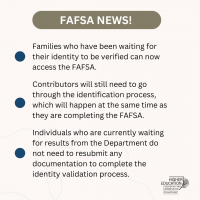

FAFSA - Free Application for Federal Student Aid: Fill out the 2026-27 FAFSA (federal grant money for citizens, eligible non-citizens)

ORSAA - Oregon Student Aid Application - Fill out the 2026-27 ORSAA (instead of filling out the FAFSA) - State grant money for students who are undocumented, or have DACA-mented (Deferred Action for Childhood Arrivals) or TPS (Temporary Protected Status).

Financial Aid Resources for Undocumented/DACA-mented students

Oregon Opportunity Grant - Oregon's largest, needs-based grant program for college students.

Chafee Education & Training Grant - This grant provides funding to help current or former foster care youth with post-secondary education and training.

Oregon Barber & Hairdresser (B&H) Grant Program - This program provides one-time grants to low-income students who are attending a participating school in a financial aid eligible program.

Oregon National Guard State Tuition Assistance - The Oregon National Guard State Tuition Assistance (ONGSTA) program provides funding for current Oregon National Guard Members enrolled in an eligible Oregon post-secondary institutions for undergraduate tuition, certain fees, and a book allowance.

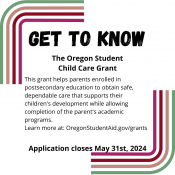

Oregon Student Child Care Grant - This grant helps parents enrolled in postsecondary education programs to obtain safe, dependable care that supports their children's development while allowing completion of the parent's academic programs.

Oregon Teachers Scholars Program - The Oregon Teacher Scholars Program (OTSP) Grant provides funding for eligible Oregon resident students who are culturally or linguistically diverse that are enrolled and pursuing their preliminary Licensure for teaching, school counseling, school social work, and school psychology.

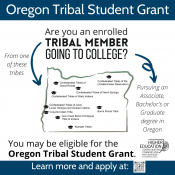

Oregon Tribal Student Grant - The grant is for eligible Oregon tribal students to help cover the average cost of attendance after all federal and state grants/scholarships have been applied.

Additional Resources to help pay for post-high training & college

Oregon Opportunity Grant - Oregon's largest NEEDS-BASED grant (based on student & parent income from prior tax year, as determined by FAFSA or ORSAA. The money runs out, so APPLY for FAFSA/ORSAA ASAP after the applications open to qualify for all the FREE MONEY you can!

Oregon Promise Grant - Free Tuition & Fees at Oregon Community Colleges (for those who qualify)

Oregon Promise Grant - FREE/LOW-COST tuition at any Oregon community college

You can qualify for the Oregon Promise Grant if you have...

- 2.0+ GPA by the end of senior year

- Lived in Oregon 12+ months before starting college

-

Completed & submitted your FAFSA/ORSAA by June 1st

- Listed at least ONE Oregon community college on your FAFSA or ORSAA

- Completed & submitted the Oregon Promise application by June 1st

- Enroll at least 1/2 time (6+ CR) at an Oregon community college the term directly following graduation (excludes summer!)

Oregon Promise: Info for Students (ENG) - YouTube video (1:40)

Oregon Promise: Info for Students (SP) - YouTube video (1:52)

OSAC Scholarships

OSAC Scholarship Application - DUE by 11:59 PM on Monday, March 3rd, 2025.

Early Bird Deadline: Submit by 11:59 PM on Tuesday, February 18th, 2025 to have your name entered into a drawing for one of several $1,000 scholarships!

Fill out ONE application to apply for multiple scholarships!

Finally, here's what you can expect from the FAFSA process from start to finish.