Financial Aid Applications (FAFSA/ORSAA)

FAFSA & ORSAA: Financial Aid Applications

IMPORTANT NOTE FOR THIS YEAR'S FAFSA APPLICANTS (2025-26 FAFSA): RHS seniors (CO 2025), the FAFSA is opening LATE again this year (by December 1st, 2024) due to changes approved by Congress and the Department of Education (DOE).

These changes will affect all students applying for financial aid and attending college in the 2024-25 school year and beyond!

The FAFSA Simplification Act requires changes to most aspects of the processes and systems used to award federal student aid, including acquiring a new interface to directly receive federal tax information from the Internal Revenue Service (IRS). The new FAFSA is supposed to be shorter, have a more simplified process, and provide a more direct interface with the IRS instead of relying on manual entry of finances for students and parents/guardians.

Every year, students and their parents can file their financial aid application, FAFSA (Free Application for Federal Student Aid) or ORSAA (Oregon Student Aid Application), for the upcoming school year (for the Fall of the year your student begins college).

- FAFSA is for students who are U.S. citizens or permanent residents.

- Students who don't have social security numbers, citizenship/resident status, or have DACA-mented status should file the ORSAA.

Completing and submitting your FAFSA or ORSAA each year you're in school is the first step in applying, and potentially securing, funding for college or other accredited post-high institutions and programs. All students interested in attending a post-high institution or training program should apply for the FAFSA or ORSAA whether you think you qualify for funding or not. Many scholarships and grants require that students at least submit a FAFSA or ORSAA, regardless of their eligibility to receive federal federal money (FAFSA) or state funding (ORSAA).

Complete the FAFSA or ORSAA as soon as possible after the applications open, as some state/federal grants are issued on a first-come, first-served basis: once the money's gone, there won't be anymore until the following financial aid cycle. Once a student completes and submits their FAFSA or ORSAA, they will receive an email confirming their FAFSA submission, which will include FAFSA submission date and time. Save the confirmation email for your records.

Financial aid, in most cases, is generally determined by your family's income (as evidenced by prior year taxes and current assets/investments/other income), as well as the number of people in your family (as shown on prior year's taxes). The number of family members in college will NO LONGER BE USED to calculate aid eligibility.

-

A Pell Grant is FREE MONEY from the federal government that you don't have to pay back. The maximum Pell Grant amount is determined annually by the federal government (Oregon matches the federal Pell Grant amount for ORSAA).

-

The maximum annual PELL Grant award amount is usually published before the new FAFSA application opens.

- Maximum Federal Pell Grant award was $7,395 for the 2024–25 award year (July 1, 2024, to June 30, 2025).

-

Students who file their FAFSA/ORSAA early enough may also qualify for funding through the Oregon Opportunity Grant, Oregon's largest state-funded, need-based grant. OOG is awarded to Oregon residents of all ages who are pursuing their first associates degree or bachelor's degree at an eligible public or private institution. Award amounts vary based on student's financial need and type of institution the student attends. A separate application is not required; eligible students may receive the OOG based on financial info provided on their FAFSA or ORSAA

- Maximum OOG award amounts in 2023-24 were: $900-$3,900 for community college; $1,788 - $7,524 for 4-year university programs, in addition to the Pell Grant).

-

The maximum annual PELL Grant award amount is usually published before the new FAFSA application opens.

IMPORTANT: Federal and state funds may run out, so make sure to fill out your FAFSA/ORSAA ASAP after the applications open; don't miss your chance to get FREE money for education and training after high school!!!

HS Grad YR When does it OPEN? SCHOOL YR? FAFSA/ORSAA year? Federal TAX YEAR MAX Pell Amt.

CO2025 by December 1st, 2024 July 1st, 2025-June 30th, 2026 2025-26 2023 IRS Form 1040 $7,395/yr

CO2026 October 1st, 2025* July 1st, 2026-June 30th, 2027 2026-27 2024 IRS Form 1040 TBD

CO2027 October 1st, 2026* July 1st, 2027-June 30th, 2028 2027-28 2025 IRS Form 1040 TBD

CO2028 October 1st, 2027* July 1st, 2028-June 30th, 2029 2028-29 2026 IRS Form 1040 TBD

* Subject to changes based on guidance from the federal government & current laws.

Use these CHECKLISTS to gather all of the documents you need to file your FAFSA / ORSAA

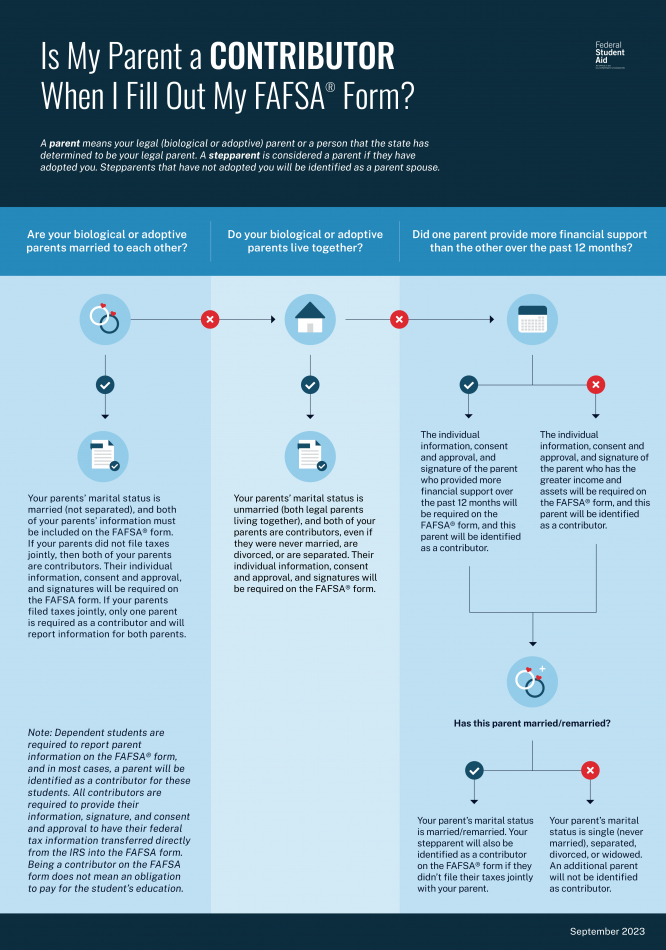

Dependency Questions: Are you a DEPENDENT or INDEPENDENT student?

High school students must provide parent info on the FAFSA/ORSAA until age 24 (in most cases).

- "Dependent" students - Must provide parent demographic & financial/tax info on the FAFSA until student turns 24 years old.

- "Independent" students - Parent info is not required; only required to provide student demographic & financial info.

FAFSA/ORSAA Tips for Parents

What Happens Next? Following up on your FAFSA/ORSAA status once you submit your application...

Many students are selected for a process called VERIFICATION. FAFSA will require you to provide proof of the information you entered in your online application. It's VERY IMPORTANT to respond to their requests for additional documentation in a timely manner; you will not be qualified to receive financial aid without it!

Here are examples of some of the documentation they may request if you are selected for VERIFICATION:

- FAFSA Verification Worksheet

- A signed copy of all pages of the student's and/or parent's FEDERAL TAX RETURNS or a TAX TRANSCRIPT from the IRS (see Form-4506 for options to request a tax transcript); they may also request W-2s for the same tax year

- Dependency Verification form

- Verification of household size form

- Verification of "no income" form (can be for student &/or parent, guardian)

It's also important to know that your FAFSA may be REJECTED for a number of reasons, usually because of a discrepancy/questionable information submitted on the online form. If your FAFSA is REJECTED, it will not be processed and you will not be eligible for any money until you make the appropriate corrections as soon as possible.

Email Shannon Selby in the College & Career Center if you need help with your FAFSA/ORSAA at any step in the financial aid process. There are many helpful links and videos about the FAFSA/ORSAA process below.